By Charlotte Atchley

May 2021

Around the

World

Globalization expands both consumer experience and business opportunities for the baking industry.

Technology has grown by leaps and bounds; just a look at the past 10 years proves how much has changed. As technology has leapt forward, it has shrunk the world for consumers but expanded it for business, and the baking and snack industry is no different.

“Globalization has had a huge impact on consumption trends in bakery and snack,” said Carolina Moré, marketing director, Europastry USA, Long Island, NY. “There are products that doubtless become global such as baguettes, donuts and croissants, products one can find in almost every part of the world.”

While certain bakery and snack products are ubiquitous, each is tweaked to target specific regions’ preferences in flavors, textures and health concerns.

“Innovation and scientific research, especially when focused on improving production and nutrition, have also intensified, becoming requirements for companies with international scope to respond to global demands while remaining competitive,” said Rafael Juan, chief executive officer of Vicky Foods, a global company based in Valencia, Spain, that owns the Dulcesol brand.

And as globalization impacts consumer trends, it also has become a major part of doing business. From supply chain optimization to expanding in emerging markets, baking and snack companies are looking worldwide for growth opportunities.

Doing business globally

As the baking industry has grown, companies have looked beyond their home country’s borders for expansion opportunities.

Today’s multinational companies like Europastry, headquartered in Barcelona, Spain, and Vicky Foods span the globe with their bakery and snack brands.

“In our case, internationalization has been a key aspect of our business strategy,” Ms. Moré said. “It has allowed us to grow in countries such as the United States and the Netherlands through our different acquisitions.”

This has become a business strategy for many larger food manufacturing companies. Grupo Bimbo, Mexico City, the largest baking company in the world, has a presence in 33 countries, a far cry from its humble beginnings as a family-owned bakery 75 years ago. And it continues to grow through acquisitions around the world, most recently acquiring a production plant in Medina del Campo, Spain, from Cerealto Siro Foods and Modern Foods in India. In a call with investment analysts, Daniel Servitje, chief executive officer and chairman of Grupo Bimbo, said the acquisition in Spain would enable the company to enter that region’s sweet baked goods private label market. The company also expects growth to come from Brazil, Russia, India and China, as it reported to investors in the fourth quarter of 2020.

Other major players are also finding opportunities around the world. At the Consumer Analyst Group of New York conference earlier this year, Mondelez International, Deerfield, Ill., reported record share gains in chocolate in the United Kingdom and cookies in the US and China. The company’s Oreo brand most notably has room to grow in other markets, said Dirk Van de Put, chairman and chief executive officer.

“We are leaders in the US and China, but in other markets, we are under-indexed with significant opportunities,” he explained in a call with investors.

For Gruma, the Monterrey, Mexico-based company, which owns Irving, Texas-based Mission Foods, reported seeing future demand in Europe and growth for its pizza business in Asia and Australia.

“We are producing not only for the retail, which is growing, but also in a very important way, we are providing pizza bases for most of the pizza, let’s say, restaurant chains in that area,” Raul Cavazos Morales, chief financial officer, told analysts during a Feb. 25 conference call about the company’s pizza bases business. “Now we are introducing these products in the US. We will start to also offer to the market the pizza bases as well in Europe.”

Much of the room for growth in baking and snack categories is found in emerging countries, Mr. Juan explained.

“Generally speaking, emerging countries currently represent the greatest business opportunity for the snack industry for two reasons: their demographic growth and their increasing income and purchasing power,” he observed.

Many expect the Asia region to dominate sales in the coming years, specifically China.

“We all understand that certainly the Chinese market is still a growing market and expect there to be a real growth opportunity,” said Chuck Metzger, chief executive officer, Hearthside Food Solutions, Downers Grove, Ill. “We are seeing multinational companies building plants there, especially in the baking sector.”

In its 2020 bakery report of the Asia Pacific region, Euromonitor showed that baked good sales experienced healthy growth from 2015-2020, largely thanks to China. The research firm expects the category to expand in China in 2021 as well as the entire region.

During a virtual presentation at the Consumer Analyst Group of New York conference, General Mills, Minneapolis, reported it saw opportunity in core markets such as France, the UK, Australia, China, Brazil, India and North America.

Globalization certainly provides these major players with plenty of new markets to play in and sell their products, but it also offers new suppliers for ingredients and other raw materials. The opening up of the global supply chain over the past few decades has helped companies cut costs.

“One positive aspect is the ability to boost competitiveness now that raw materials can be bought from every corner of the globe,” Mr. Juan said.

This opens the door to cheaper raw materials and labor costs by moving production capacity internationally. This global supply chain, however, doesn’t come without risk and trade-offs. Transparency and traceability become paramount as countries put in place more food safety regulations, such as the US’s Food Safety Modernization Act. Bakers must vet international suppliers and create a paper trail to prove food safety standards are being met.

“We’ve had to shift more company resources to keep up with those regulations and vet suppliers against the regulations,” Mr. Metzger said of the challenge.

And the coronavirus (COVID-19) pandemic frayed the edges of this interconnected supply chain. While a globalized supply chain would seem insulated against world events that are isolated, a pandemic impacts every part of the world, from the source of the ingredients to processing and shipping. As baking companies reevaluate the vulnerabilities revealed by the pandemic, Mr. Metzger believes the industry will move to a hybrid supply chain approach.

“It’s going to be a healthy balance between domestic and global suppliers; I don’t think there will be a full pivot back to domestic,” he said. “Companies will split their supply chain between domestic and low-cost, global models. Companies will become more strategic in terms of how they think about their supply in critical areas.”

This can also look like partnering with suppliers who are local to the area of a specific production facility. Europastry operates with a business model of “think global, act local.”

“Although we are a large company, we work with local suppliers and strive to make the entire value chain a more sustainable process,” Ms. Moré said.

Catering to a global consumer base

As baking companies reach more international consumers with their products, they must tailor them to each region’s tastes. While some trends have gotten global traction — clean label and health and wellness — the specifics can change from place to place.

“Clean label and organic have been on the rise in consumer trends and are even more important now,” Ms. Moré said, referencing the pandemic. “Health and wellness are important to today’s consumers. Whole grain, vegan and fiber-rich products are on the rise as consumers are changing their diets as they become more health conscious.”

In Grupo Bimbo’s fourth quarter presentation to investors, the company reported that it sees growth for the US market in organic and gluten-free claims on baked goods, while Western Europe gravitated toward claims like whole grain and high fiber breads. Reduced fat and sugar claims are also popular in Western Europe, according to a report on 2020 bakery by Euromonitor. Euromonitor also reported that health and wellness grew in the minds of Greek consumers as more consumers in that country are becoming interested in veganism.

While these universal trends may be on the rise, how they play out in specific products differs, depending on the country.

“Our products must adapt to each country’s consumption habits,” Mr. Juan said. “At Vicky Foods, we do this by adjusting our recipes, either by adding or removing ingredients or changing the flavors of the existing products accepted in those countries. We also test and launch new products that reflect local trends with the collaboration and expertise of our partners in those markets.”

Europastry accomplishes this with its four innovation centers, or Cereal Centers, which are located strategically around the world with two in Spain and one in both the Netherlands and the United States. Teams of food scientists, nutritionists, chefs and bakers work independently on products that will suit their markets.

Those that are perfected can find new markets around the world when appropriate.

“Our distribution structure allows us to get to know these products in other countries so we can innovate internationally and remain at the forefront of bakery innovation,” Ms. Moré said.

To address the ever-changing, vague definition of natural and clean label, Europastry keeps its eyes on three key pillars to guide its innovation in this space: heeding traditional baking recipes, respecting the preparation procedures of our master bakers and preserving the best flavors.

While health and wellness might be at the forefront of consumers’ minds around the world, both Europastry and Vicky Foods also see a movement toward supporting local businesses and supply chains.

“In recent months, consumers have been very vocal about advocating for local products,” Mr. Juan said. “Also, nostalgia, which has facilitated the revival of products that were successful in the past.”

This has also been reflected in the fact that Mr. Juan said they have noticed local companies gaining more market share in recent years as more mature markets see a surge of local brands.

Despite this interest in nostalgia, health and wellness and supporting local brands, Europastry noted there is room for innovation.

“People still want to try new things; they are open to indulgences and innovation,” Ms. Moré said. “All-time classic products such as brioche or indulgent products like anything filled with chocolate or our range of more rustic artisanal breads made with sourdough and long fermentation times, all of these are guaranteed successes.”

While the pandemic may have shifted the global baking industry around, its global strength cannot be denied.

“It’s a multi-billion-dollar business that’s growing around the world,” Mr. Metzger said. “It’s not a flat or declining business, especially in the US, and globally there’s more potential. The potential to expand into developing markets is very high.”

You might also enjoy:

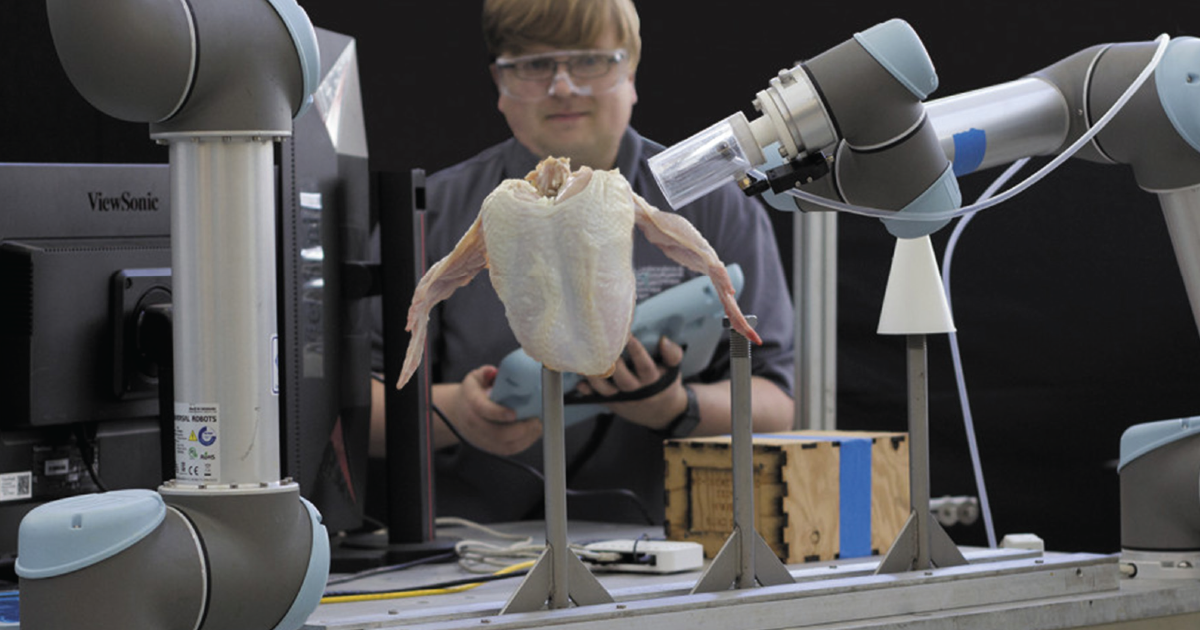

Overcoming obstacles and chasing innovation, the pet food industry prepares for its promising future.

Today’s meat and poultry processors carefully manage expectations to feed people, preserve the planet and deliver profits in the future.

Slaughtering and processing facilities where meat and poultry are manufactured have improved dramatically over the past 100-plus years.

Added value becomes nonnegotiable for global companies

Consumers around the world are demanding one thing more and more from food manufacturers: sustainably and ethically produced food.

Sustainability programs, transparency across supply chain and using buying power to improve agriculture practices have increasingly shown up in corporate mission statements. Grupo Bimbo, for example, is well-known for its commitment to be a “sustainable, highly productive and deeply humane company.”

The Mexico City-based company sets lofty sustainability goals—100% renewable electric power, 100% recyclable, biodegradable or compostable packaging by 2025 — and creates programs to support employees. In its 2020 Q4 investor presentation, Grupo Bimbo reported that 100% of its facilities in the United States and 85% of facilities in Mexico are powered by renewable energy while it has also reduced packaging by more than 3.3 million kgs in the past 10 years.

Europastry, Barcelona, Spain, has created the Responsible Wheat label to identify best practices in wheat farming. This means supporting local farmers, using certified seeds, reducing fertilizers, implementing crop rotation practices and traceability from farm to table. The company has currently dedicated 5,300 hectares to Responsible Wheat and aims to increase that number to 20,000 by 2025.

“Our quest for sustainability is a given,” said Carolina Moré, marketing director, Europastry. “We are increasingly committed to drastically reducing not just the carbon footprint of our activity but also that of the entire value chain.”