By Andy Nelson

March 2021

The rise

of fresh

Where the grocery perimeter’s been,

where it is now,

and where it’s headed

ClassicStock / Alamy Stock Photo

In the 1970s, when Rick Stein was in the early years of his career in retail grocery, perimeter sales made up about a third of total sales for the East Coast chain he worked for.

Meat and produce were big. But many stores didn’t even have what we would consider retail foodservice today. And the instore bakery was still a gleam in most retailers’ eyes, if that. Deli prepared? Sure, but it might be fried chicken (but no rotisserie), a few sides, maybe livers and gizzards, and not much else. And forget about grab ‘n go.

When Stein left the company in 2013, perimeter’s one-third share had risen to more than half.

“Not only has fresh expanded its contribution to the total, it’s also expanded the footprint,” said Stein, vice president of fresh for Arlington, Va.-based FMI – The Food Industry Association. “In our annual Food Industry Speaks report, members tell us what’s going on. And what’s happening is stores are differentiating themselves in the perimeter. It’s a part of their key strategy.”

And there’s no reason to think that, once the pandemic is in the rearview mirror, it won’t continue to rise.

“I believe the fresh perimeter will continue to thrive, for a number of reasons,” Stein said. “For one, many items in the perimeter are key ingredients to making meals.”

Even if people don’t cook an entire meal from scratch, Stein said, chances are they’re getting a good number of those ingredients from the perimeter. Maybe they buy the steak from the meat case, then add a salad kit from produce and a prepared side from deli/prepared.

Another reason is health.

“Health and wellbeing have never been more in the forefront,” Stein said. “The virus is hurting people with underlying conditions. When you’re cooking at home, you’re thinking about the foods you eat day after day, and health is often affiliated with the fresh departments.”

Building the perimeter

of the future

A to-do list for retailers from IDDBA’s Eric Richard

Several years ago, Eric Richard and several of his colleagues at the Madison, Wis.-based International Dairy Deli Bakery Association read an article about the “experience economy” and the ever-greater role it would play in luring consumers into retail stores and keeping them there.

That emphasis on consumer experiences went on to inform IDDBA’s What’s in Store Live displays at its annual conventions, and it’s one of the first things Richard, IDDBA’s industry relations coordinator, thinks about when the topic of the evolution of the grocery fresh perimeter over the decades comes up.

“The importance of experience in the fresh perimeter is especially important, with all of the new channels competing with grocery,” he said. “When I was growing up, people shopped at ShopRite, or Pathmark. They didn’t shop for groceries at the convenience store or a club store.”

With so much more competition in the market now, creating experiences consumers will remember is more important than ever, Richard said. And supermarkets, while facing intense competition, still have built-in advantages the other channels can’t hope to match.

“You’re not going to smell fresh bread being baked, you’re not going to see sandwiches or pizza being made, or the variety of cheeses, or sampling,” he said. “Fresh departments have greater roles now than they had decades ago.”

Produce butchers preparing just-purchased whole fruits and vegetables for consumers is one of the many types of experiential upgrades likely to be seen more frequently in the new normal, Stein said.

In retail fresh seafood, which has exploded during the pandemic, expect seafood mongers to play an ever-greater role, helping consumers with cooking and pairing advice.

The same goes for butchers in the meat department. And technology will continue to play a big role. Stein said some retailers now have screens in their departments with videos showing how to prepare and cook certain cuts. Sales for those cuts have soared accordingly.

There’s no denying the explosion of ecommerce in the retail grocery space, particularly in the wake of COVID. But at the end of the day, Richard said, shopping online is not the same as shopping in the store, particular in the store’s fresh perimeter departments.

Ecommerce’s growth will obviously continue apace even after the pandemic has finally passed, but Richard is optimistic about brick-and-mortar’s future, particularly when it comes to the perimeter.

You might also enjoy:

Looking ahead, producers, processors and retailers must appeal to evolving demographics.

Argentina-based company has made major inroads with HB4 wheat in Argentina, has sights set on Australia and the US

Even some of the hardest-hit categories are expected to pick up where they left off pre-pandemic.

“Prepared foods has taken a big hit in the past year, but going into the pandemic it was doing very well, and it’s an area that going forward can really help supermarkets evolve and compete more with quick-serve and other foodservice channels,” Richard said. “More and more people look to supermarkets as an option for prepared foods.”

Past evolutions of the perimeter that will continue in the future, he added, will include more food halls, food courts and grocerants that will plant more and more grocery stores firmly in the foodservice world.

“I think we’ll get back there,” he said. “Statistics show that the trend of people eating away from home will continue. The supermarket is going from mainly a place where you get your ingredients to a prepared food destination.”

Hand-in-hand with that, Richard said, is supermarkets’ growing role as a hub of information for shoppers — something else that evolved in recent decades. IDDBA, for instance, is currently working on implementing a charcuterie certification program that will help retailers explain a complex industry to a consumer base that is ravenous for information on the topic.

The same goes for cheese, for entertaining in general and for countless other aspects of the perimeter experience where education could open a world of opportunity to grocery retailers.

“Trending flavors, foods consumers haven’t tried but want to try — the supermarket can educate people about what they’re selling and tell those stories – the grocery store becomes the storyteller,” Richard said.

Another huge change that has affected the perimeter, and grocery stores in general, over the decades has been demographics-based, Richard said. Namely: households, on average, aren’t nearly as big as they used to be.

“Forty to 50 years ago you’d be shopping for a family of four or five. Now it’s a single person, or someone and their partner. The size, the quantity, how it’s packaged has all changed.”

That’s definitely true in the instore bakery, Richard said. Not everyone is looking to buy an entire loaf of bread these days. Maybe they want half a loaf, or even just a few slices.

“Demographics have impacted how products are merchandised,” he said. “It’s true in the deli, too. Not everyone wants a pound or a half pound of turkey. Maybe they want a quarter-pound instead.”

“When we get back to normal we’ll see all these trends that were emerging before the pandemic, plus new innovations. There will definitely be continued growth on the fresh perimeter. At the end of the day, when it comes to supermarkets, the fresh perimeter is really the draw.”

One change in the perimeter that is more recent, Stein said, is the emphasis on locally grown and sourced foods and on assortment.

“Think of a produce department in, say, 1979, or 1983. In the mid-Atlantic, where I grew up, if it was January, you’d see a lot of hard goods —apples, pears, onions and potatoes —but not soft fruit. You’d have to go to frozen for that.”

Now, with imports, it’s easy to find almost whatever you could possibly want in the way of a fresh fruit or vegetable, year-round.

Stein also expects retail foodservice to continue making the huge strides it was pre-pandemic.

“Stores’ culinary capability has really blossomed in the last 10 years,” he said. “They’re competing with restaurants.”

Some things could permanently change due to COVID, however. Donuts from the instore bakery are more likely to be marketed packaged. Hot bars will return, but for now, instead of consumers serving themselves, a clerk will dish up their foods to avoid too many hands touching the same serving spoons and ladles.

Salad bars may be repurposed as grab ‘n go premade salad areas. (Repurposing could be a necessity for many retailers who have invested in expensive equipment, some of which isn’t easily moved.)

Retailers can look to capitalize on that repurposing by adding other cold grab and go deli prepared items. Some, for instance, have already seen success marketing cold chicken wings in repurposed bars, Stein said. Retailers may worry about the added labor expense, but Stein said volume can make up for that if consumers see value in it.

“One retailer put their wing bar into full-service, and they sold through the roof,” he said.

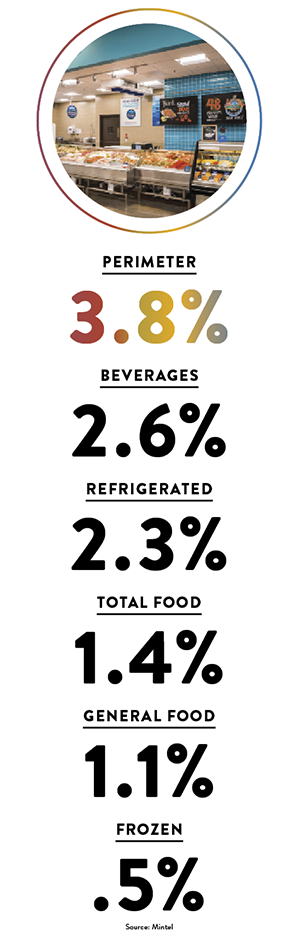

The star of the store

Dollar sales growth: 4-year CAGR

Hy-Vee: What’s changed, what’s stayed the same

We asked Dawn Buzynski, director of strategic communications for West Des Moines, Iowa-based Hy-Vee, to share her thoughts on how the fresh perimeter has evolved for the retailer.

Supermarket Perimeter: Looking at the perimeter as a whole, what have been some of the big changes over the years?

Dawn Buzynski: For Hy-Vee, the perimeter has evolved from your more traditional offerings – meat, dairy and produce – to the very best selection of those items, plus things like artisan breads, prepared meals, fast-casual dining options, charcuterie, cheeses and more. While much has changed with what we offer our customers over the years, our commitment to quality produce, fresh-baked breads and a variety of meat and meal options in our perimeter is still a focus.

SP: What about produce?

Buzynski: Hy-Vee’s produce section has always been a colorful point of entry greeting for customers. It’s changed over the years in both quality and offerings, and the selection has evolved with the availability of specialty items to offer our customers. Over the years we have added organic and specialty items, adding to a much wider selection. Country of Origin Labeling (COOL) is important for customers because they want to know where their produce is coming from. Advancements in shipping and technology allows us to procure quality produce across the global as well as locally. When we are not able to source items locally, we have invested in technology – from the warehouse, to transportation and in-store, to keep produce from around the world – such as bananas – fresh. We’re proud of our Hy-Vee Homegrown initiative, where we partner with local family farmers within a 200-mile radius of a particular store to provide customers with local options. This not only supports local communities, but it provides our customers with the freshest produce from farm to store.

SP: What other perimeter departments have seen big changes over the years?

Buzynski: Over time, we’ve incorporated coolers into the perimeter at the front of the store for quick grab-and-go options, including take-and-bake prepared foods. As we move forward, we remain committed to staying on the forefront of trends and offering our customers the best experience in fresh. We offer a large selection of artisan breads, charcuterie, a world-class meat and cheese selection, and many prepared food options. Prepared foods include our Hy-Vee Mealtime-To-Go selections, which are made fresh in-store and allow customers to take pre-made meals home to feed their families. Fast-casual departments, such as Hy-Vee Chinese, Nori Sushi, Hickory House, and Italian round out the prepared meal options with something for every palette.

SP: What role has technology played in the evolution of the perimeter at Hy-Vee?

Buzynski: Data has been a critical factor in changing the offerings, variety and price points of fresh foods offered throughout the perimeter. By using consumer purchase behavior data, along with focus groups and secondary research, we’ve been able to continuously evolve our perimeter to meet the needs of our diverse shopping population. As we’ve seen the interest in fresh food increase, we’ve also had the data to support growing the footprint of the fresh perimeter, to allow for greater product selection and variety.