By Arvin Donley

November 2022

Bioceres making its

push with GM wheat

Argentina-based company has made major inroads with HB4 wheat in Argentina, has sights set on Australia and the US

©Brian Jackson – stock.adobe.com

Hindered by climate change, supply chain dysfunction and geopolitical tensions, global wheat production and trade have leveled off the last several years, with global ending stocks now at a 10-year low. Consequently, the need for increased yields and wheat varieties that can grow in suboptimal conditions has never been greater as global food insecurity has reached unprecedented heights.

One solution would be the adoption of weather-tolerant genetically modified wheat varieties. But embracing biotechnology, particularly when it comes to a food grain like wheat, has never been simple. Despite the preponderance of scientific evidence showing that GM wheat, as well as other grains, are safe to consume, a significant and vocal minority of consumers are adamant in their disdain for all things genetically modified.

Thus, flour millers and other downstream wheat-based food processors, many of whom are privately intrigued by the possibility of GM wheat commercialization, take a cautious public stance to not upset customers or potential customers. For example, World Grain reached out to a number of people in the global flour milling community for comment on this issue but most declined.

In the eye of this stormy situation is Argentinean biotech company Bioceres Crop Solutions, the maker of HB4 wheat, a genetically modified, drought-resistant variety that during the past two years has gained acceptance and regulatory approval in several South American countries and also has cleared preliminary regulatory hurdles in Australia and the United States.

Frederico Trucco, chief executive officer of Bioceres, is optimistic that HB4 is on a trajectory for commercialization in several key wheat-producing countries in the coming years. But the payoff is rarely quick for biotechnology companies, which is something he is always reminding investors. After all, it’s taken nearly 20 years since the introduction of HB4 technology in 2003 to develop wheat varieties and start to gain regulatory approvals that may pave the way for commercialization.

“It’s been a long journey,” he said. “These technologies are developed over decades, not just a few months or a year. When investors think of technology, they probably think of the computer software sector where things get replaced very quickly. (Monsanto’s) Roundup Ready soybeans were first commercialized in Argentina in 1994 and the patent didn’t expire until 2014. It takes a long time to develop but they last for many, many years.”

Of the many stakeholders in the wheat value chain, nobody is more excited about the prospect of HB4 commercialization than the wheat growers who for many years saw corn and soybean yields skyrocket due to biotechnology while wheat yields remained stagnant with only conventional varieties available.

Bioceres said HB4 drought-tolerance technology has been shown to increase wheat yields by an average of 20% in water-limited conditions, a key adaptation that favors double-cropping systems, where water management is increasingly critical. It also has shown environmental benefits. Under no-till practices, HB4 soy-wheat rotations result in an estimated 1,650 kilograms of carbon fixed into the soil per hectare per year, compared to positive emissions from conventional soy monoculture, Bioceres said.

“GM technology is something US wheat producers have supported since they adopted that principal document,” said Dalton Henry, policy director of US Wheat Associates, referring to the USW/NAWG Principles for Commercialization document that supports customer choice and identifies important US wheat export markets that must approve new traits. “They realize the benefits of technology, especially when you think about traits like drought tolerance. It’s impossible not to have it at the front of your mind considering the year we had last year in two pretty significant growing regions in the US.”

Trucco said an aspect of HB4 that often is overlooked is it also performs well in non-drought scenarios.

“In the past, there were drought-tolerant varieties, but the plants yielded less when water was not an issue,” he said. “In practical terms this is very important because we want technology that makes improvement in all scenarios. If it only works when you have drought, you are limiting yourself to very small environments. When we say it benefits situations where there is adequate water, we are talking about yield increases that can be as high as 40% to 50%.”

Argentina, Brazil and HB4

Not surprisingly, the first country to widely cultivate HB4 wheat, which is based on a drought-tolerant gene taken from a sunflower, came in Bioceres’ home country of Argentina. Bioceres developed the HB4 wheat strain in partnership with the National Council for Scientific and Technical Research and the National University of Litoral. While not technically commercialized in Argentina, it is being grown by many farmers under Bioceres’ supervision.

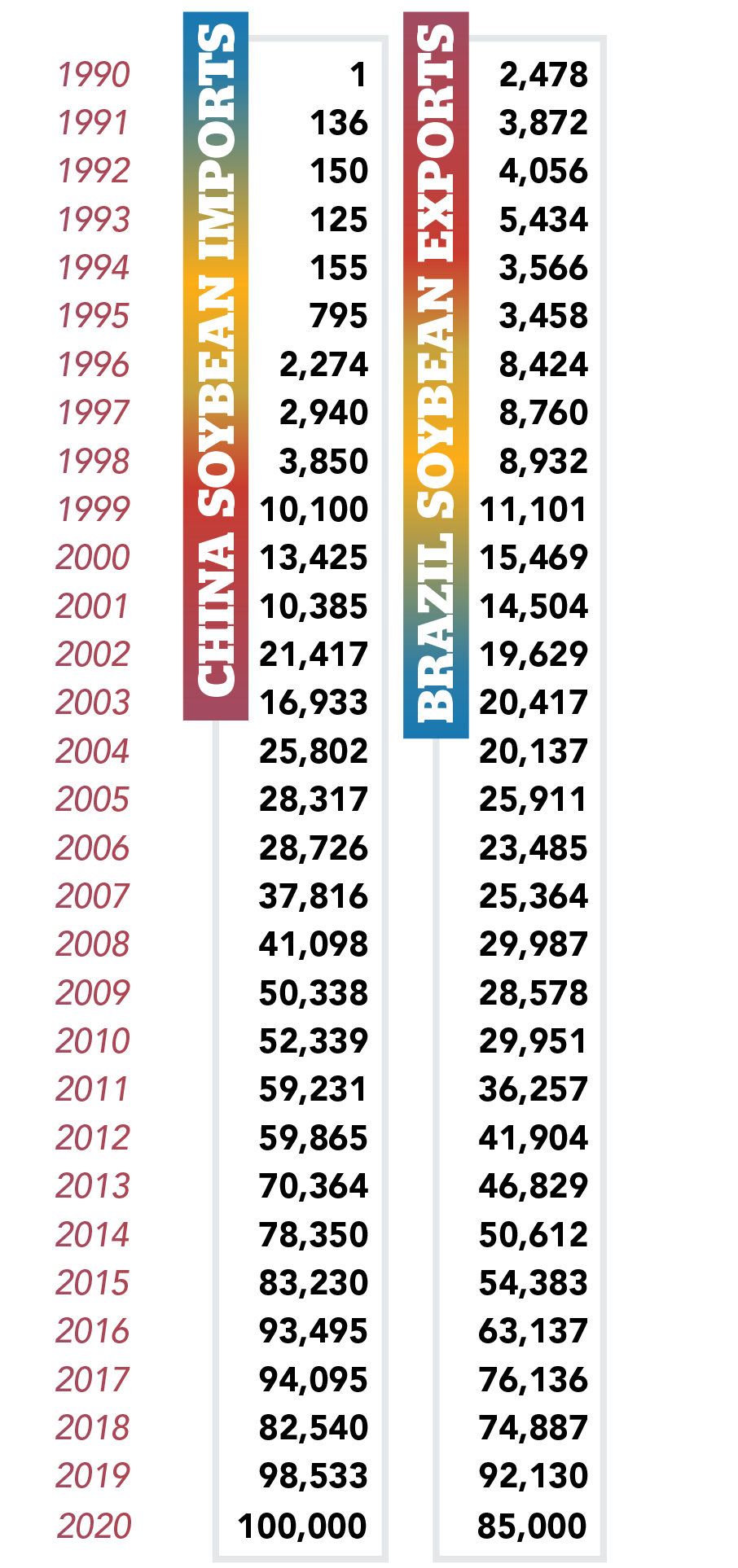

In October 2020, Argentina, the largest wheat producing country and exporter in South America, granted first approval of HB4 wheat for growth and consumption. The commercialization of HB4 wheat in Argentina was subject to Brazilian approval, as Brazil is the main export market for Argentinean wheat production.

In November 2021, after a rigorous review process, the Brazilian National Biosafety Commission unanimously endorsed biosafety conditions for flour processed from HB4 wheat. But Brazilian millers, concerned that some of their customers were not receptive to products made from HB4 wheat, threatened to stop buying Argentine wheat, vowing to turn to other countries for supplies.

But ABTRIGO, the Brazilian milling association, softened its stance after a survey of Brazilian consumers, commissioned by ABIMAPI, an association that represents biscuit, pasta, bread and cake makers, yielded a surprising result.

“A post-approval survey in Brazil showed that close to 70% of consumers had no concerns on GMO wheat, an observation that helped change the position of key groups that historically rejected transgenics in the crop,” Trucco said. “With this we are not saying that the job is done; it is far from being done. But we are obviously thrilled to see this progress and very proud of our global leadership in this front.”

Colombia is the other South American country that has approved HB4 wheat for consumption.

International strategy

Trucco acknowledged that for HB4 wheat to become a truly global product, it must expand beyond South America. So Bioceres has set its sights on Australia and the United States, two major producers that export wheat all over the world and are prone to drought.

“Australia is our most immediate international interest outside of Latin America,” Trucco said. “We are actively pursuing Australia, as it has a market twice the size of Latin America. And it is a country that traditionally is more severely affected by drought, so HB4 technology can be even more valuable to Australian growers.”

Bioceres scored a major victory in May when Food Standards Australia New Zealand approved the company’s drought tolerant strain HB4 for use in food. In June, it announced it was moving forward in its push to obtain approval to plant and produce its genetically modified drought-resistant wheat in Australia. The Office of the Gene Technology Regulator must provide approval for the planting of HB4.

Trucco said Bioceres plans to carry out field tests of its GM wheat in Australia and will seek planting approvals in 2023.

But will Australian growers embrace the technology? Brett Hosking, chairman of Grain Growers and a Victorian farmer, said growers are interested in the technology but will want to see how it performs in the field and how the variety compares to other similar ones already in the market.

“The fact that this has this drought tolerance may get lots of growers interested,” he said. “But whether they will buy a bag and try on the farm, it needs to prove itself against other varieties out there. They’ll look for paddock-based replicated trials that fit within their soil type, crop rotation, and the system they use in their farm business and climate.”

If Bioceres can secure planting approvals in Australia, it could open the door for acceptance in other major wheat producing and exporting countries such as the United States.

Just days after Bioceres received regulatory approval in Australia came word that the US Food and Drug Administration (FDA) concluded its evaluation of HB4 wheat and had “no further questions regarding the genetically modified wheat’s safety.”

Bioceres said the conclusion of the voluntary consultation program with the FDA is a key step toward commercial enablement in the United States, which is awaiting approval from the US Department of Agriculture (USDA). The United States is the fifth largest wheat producer, with an average of 15 million hectares planted every year, and the third largest exporter, holding a key position in the global wheat trade.

Trucco called the United States “probably the most attractive market.”

“So many markets depend on US wheat,” he said. “We have a strategy and idea of where the technology can be more relevant, and we’re starting to seek collaborators (in the US) that can make this happen sooner rather than later.”

Trucco said Bioceres is actively seeking US universities or companies that it can work with to do breeding work and testing.

While Henry said it was impossible to say if HB4 would ultimately be approved for commercialization in the United States, he was confident that it wouldn’t occur anytime soon.

“(Trucco) has been aggressive every time he’s asked about a timeline, and those timelines have had a tendency to slip,” he said.

While most individual millers from around the world declined comment on HB4 for this article, the North American Millers’ Association (NAMA) issued a statement following the FDA’s decision.

“The availability of high-quality, affordable wheat is essential for millers, and ultimately, consumers,” NAMA said. “There is growing demand for sustainably produced wheat that uses less water, fertilizer, fuel, and other inputs and at the same time drought has reduced wheat yields in the US and around the world. Drought-tolerant wheats like HB4 could help with global supply challenges.”

However, NAMA also noted that it “supports consumers being able to make food purchases based on their personal preferences and supported legislation requiring labeling of products that contain bioengineered food ingredients.”

Jane DeMarchi, president of NAMA, told World Grain one of the big questions that millers have about the new variety is its milling quality.

“We urge Bioceres and any company developing new varieties of wheat to do quality testing for those new varieties for milling and baking characteristics and to go through the Wheat Quality Council’s review process,” she said.

She also echoed Henry’s opinion that the introduction of HB4 into the United States “is a long way away.”

A reason for pessimism regarding the prospect of widespread commercialization of HB4 wheat is that several of the United States’ and Australia’s most loyal customers, such as Japan, have strict policies against importing unapproved varieties. A GM wheat variety inadvertently getting mixed in with a US shipment of conventional wheat to Japan in 2013 temporarily strained trade relations between the two countries.

Bioceres has stated that it will maintain its preserved identity plan and delay the commercialization of the seed until there is greater acceptance of the GM wheat and its derivatives worldwide. Trucco said he is confident that with the grain testing and sorting technology that is available, tolerance levels of 0.001% can be maintained.

“I’m not saying that contamination cannot occur; it will in the future,” Trucco said. “But it is manageable.”

Arrows pointing up for Bioceres

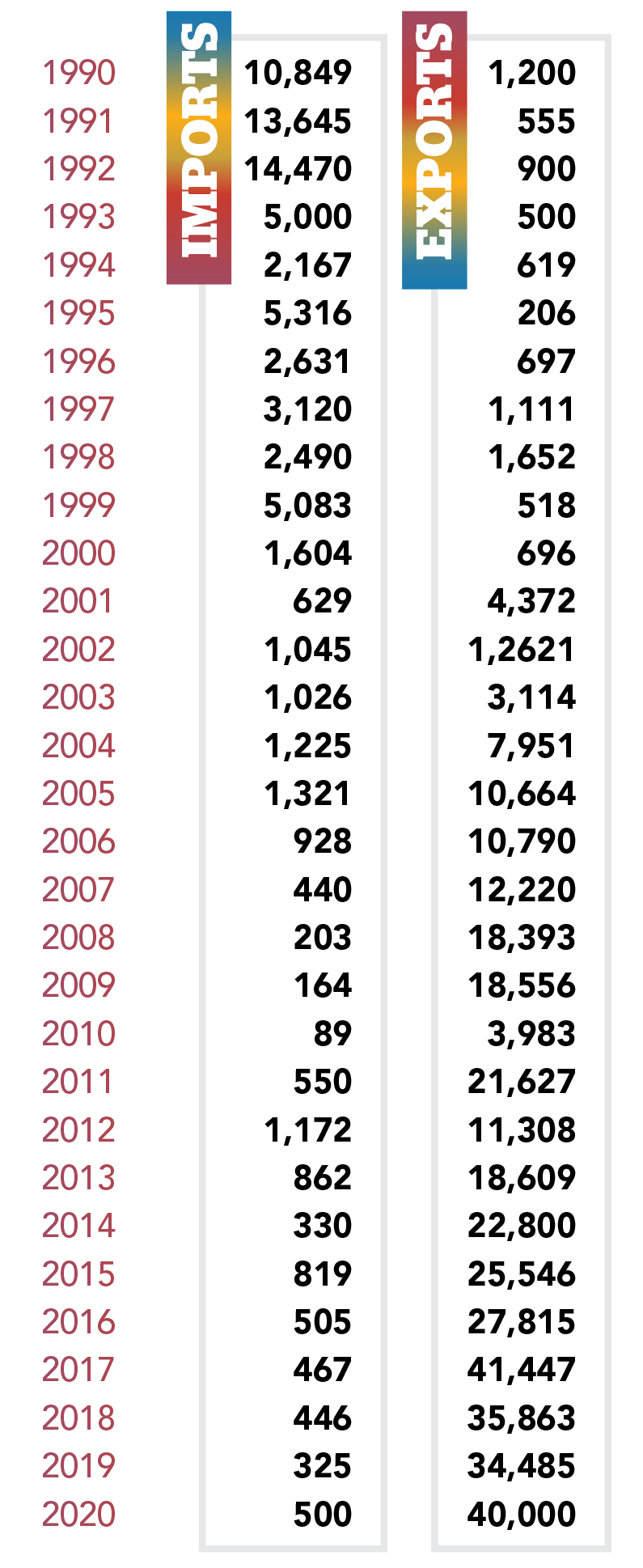

Bioceres’ fourth-quarter and full-year earnings report, released on Sept. 8, contained plenty of good news for the Argentina-based company.

Comparable gross profit for the quarter increased 32% compared with the year-ago quarter, reaching $41.4 million. Comparable gross profit for the full fiscal year reached a record of $136.9 million, up 45% compared with fiscal year 2021. Fourth-quarter revenues were up 44% to $104 million and full-year revenue was up 62% compared with 2021 to a record $319 million.

Notably, HB4 wheat revenues were $12.4 million, a 94% increase compared with the year-ago contributed goods number.

Frederico Trucco, chief executive officer of Bioceres, said key feed and food clearances obtained during 2022 were a factor in the improved results, including China’s Ministry of Agriculture approval for HB4 Soy and the US Food and Drug Administration (FDA) favorable conclusion on HB4 wheat safety assessment. Other feed and food approvals for HB4 wheat include Brazil, Colombia, Australia, New Zealand and Nigeria for HB4 wheat.

“This is an amazing closing to an amazing year, not only reflected in our record-setting financials but also in terms of achieving gatekeeping regulatory clearances, namely feed and food approvals for HB4 wheat in Brazil and for HB4 soy in China,” Trucco said. “We are, for the first time, reporting revenues associated to the HB4 technology, resulting from the one crop where we faced the most skepticism: HB4 wheat. This technology is now not only green-lighted by a growing number of regulators, including the US FDA, but also increasingly accepted growers, industry participants and consumers at the end.

“Today we have more than 20 processors incorporating HB4 wheat in their products with a similar number being onboarded in the next few months. We have consumer brands actively addressing HB4 wheat merits, and we have successfully executed the first export operation for HB4 wheat flour to Brazil.”

You might also enjoy:

Looking ahead, producers, processors and retailers must appeal to evolving demographics.

Argentina-based company has made major inroads with HB4 wheat in Argentina, has sights set on Australia and the US

The pressures of regulation and consumer demand have led to significant advances in food science for the baking industry.

Nigeria and other developing countries

Bioceres scored another victory in mid-July when Nigeria, which is home to several of the largest flour mills in Africa, became the latest country to approve the import of HB4 wheat for food and feed use. The import permit granted by the National Biosafety Management Agency of Nigeria is valid until July 2025.

Attempts by World Grain to get a response from Nigeria’s larger flour milling company, Flour Mills of Nigeria, to the government’s decision to allow HB4 wheat imports were unsuccessful.

Trucco sees countries such as Nigeria, which is a major wheat importer and has a high per-capita wheat consumption rate, as potential beneficiaries of the new technology.

“Any technology that will fortify wheat security will be viewed very favorably in these countries,” Trucco said. “And we’re not predicating our business based on premiums so I think that should be music to the ears of countries that rely on importation such as Egypt.”

Khalid Al-Hazaa, general manager of Al-Hazaa Investment Group, which operates flour mills throughout the Middle East, was one of the few flour millers willing to discuss the topic on the record with World Grain.

While he has questions about the health consequences of consuming GM wheat and whether consumers in his region would shun GM wheat products, Al-Hazaa said it may be time to consider the merits of the technology.

“The time has come to start considering this step, especially with the current increase in the world’s population and the increased demand for grains and wheat, in particular,” Al-Hazaa said. “Also, after what we’ve witnessed during the COVID-19 pandemic and the Russia-Ukraine war that caused a global grain supply chain disruption, all these factors should raise our concerns and enhance our efforts to look for solutions that could increase global production, help in good use of current agricultural lands, and overcome the problems of drought and climate change.”

Like many millers, Al-Hazaa is eager to see if Bioceres succeeds in marketing its product beyond South America.

“If the GM wheat got approved internationally, especially in large wheat-producing countries such as Australia, the United States, the Black Sea countries and Europe, then definitely countries in the Middle East would follow, especially Egypt, as it is a large producer and consumer of wheat,” he said.

Al-Hazaa noted that Egypt is “focused heavily on increasing local wheat production,” and that adopting HB4 wheat for production could be one of the means to help the country increase its yields.

While HB4’s ability to increase yields in drought conditions are the major attraction for many developing countries, Steve Mercer, vice president of communications for USW, said the other side of the coin regarding HB4 wheat is the potential environmental and sustainability advantages that it provides regarding less water usage.

“One is the practical benefit for producers to produce more wheat and the other side is the sustainability arguments, which could be attractive in developed countries,” Mercer said.

Herbicide concerns

Although HB4 wheat has received safety approvals in several countries, environmental groups warn that commercialization would lead to higher exposure to glufosinate-ammonium because it is tolerant to the herbicide.

GRAIN, a Barcelona, Spain-based non-profit organization that supports small farmers and social movements in their struggles for community-controlled and biodiversity-based food systems, said that glufosinate-ammonium is “widely questioned and prohibited in many countries due to its high acute toxicity and its teratogenic, neurotoxic, genotoxic and cholinesterase altering effects.”

GRAIN warns that the addition of GM wheat, which is grown in different parts of the year than most other GM crops, will lead to year-round exposure to glufosinate-ammonium-based herbicides.

Trucco said HB4 is resistant to the herbicide glufosinate-ammonium because in the biotechnological process Bioceres used a glufosinate-resistant gene as the selectable marker to be able to distinguish the positive transformant from the negative transformants.

“So it’s an effect of the biotechnological tool used to achieve drought resistance,” Trucco said. “Unlike with the first wave of transgenics several years ago whose main yield differential was directly associated with the use of the herbicide, HB4 was developed to have drought resistance as its main characteristic and value.

“While this means that HB4 wheat is tolerant to glufosinate-ammonium, it does not need to use this herbicide. Just as with conventional wheat, any other agricultural herbicide can be applied in the production of HB4 wheat with no impact on the quality of the wheat. In fact, at Bioceres, we are working hard to develop biological herbicides that could in the future be applied as alternatives to chemical herbicides in seed treatments. We are actually one of the only companies globally that develops all categories of biological products for agriculture: from bio-nutrition and seed genetics, to biostimulants and bioprotection technology.”

Timing is everything

Other companies, including US-based Monsanto, before it merged with Bayer, developed GM wheat only to reverse course due to strong backlash from consumer groups and tentative regulators. But that was a different time, when there was plenty of wheat in reserve and less certainty about the impact of climate change on crop production.

Today, not only is there more widespread drought impacting yields and production, but a once-in-a-century pandemic has caused global supply chain dysfunction and two of the world’s largest wheat producers and exporters — Russia and Ukraine — are at war, limiting the amount of grain being produced and shipped from the Black Sea region.

It’s hard to imagine a better environment to be introducing a high-yielding drought-resistant genetically modified wheat variety.

“I don’t know if it’s the best possible timing to be talking about that kind of trait, but it has to be close,” Henry said.